washington state long-term care payroll tax opt out

Part of that bill distorts a two-year old law giving Washington residents only until November 1st to opt out of a state program that will tax. Before we outline the process lets review some details about the new WA Cares Fund.

Washington State Long Term Care Tax Here S How To Opt Out

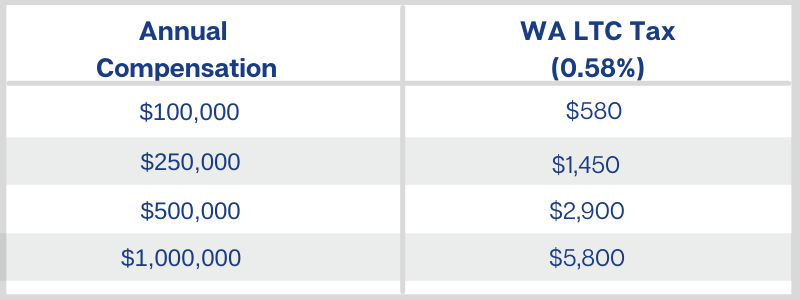

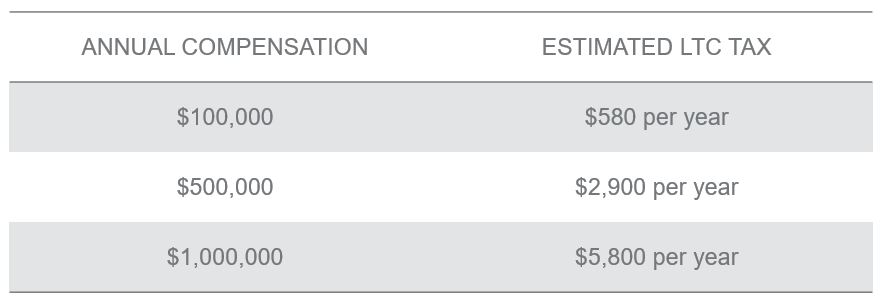

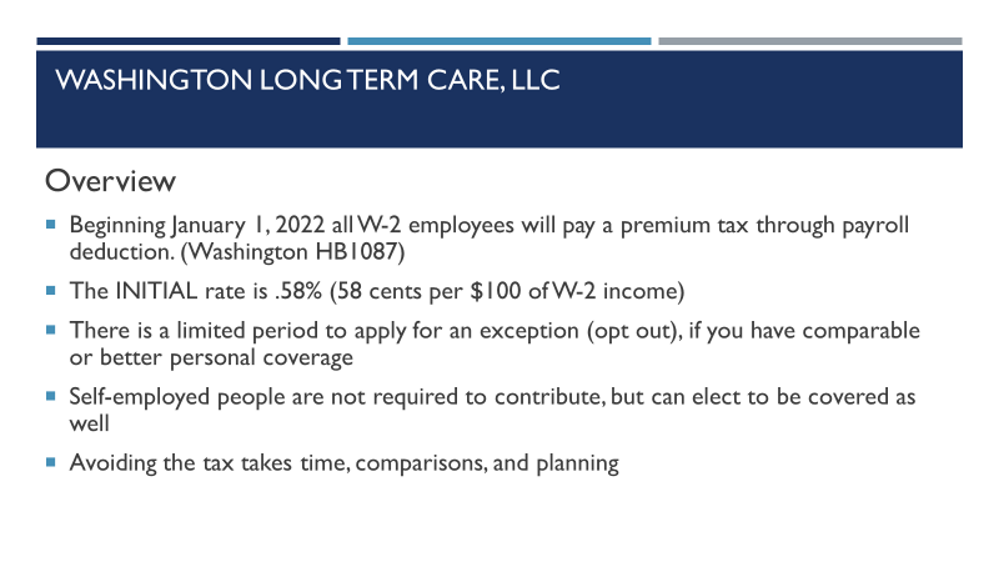

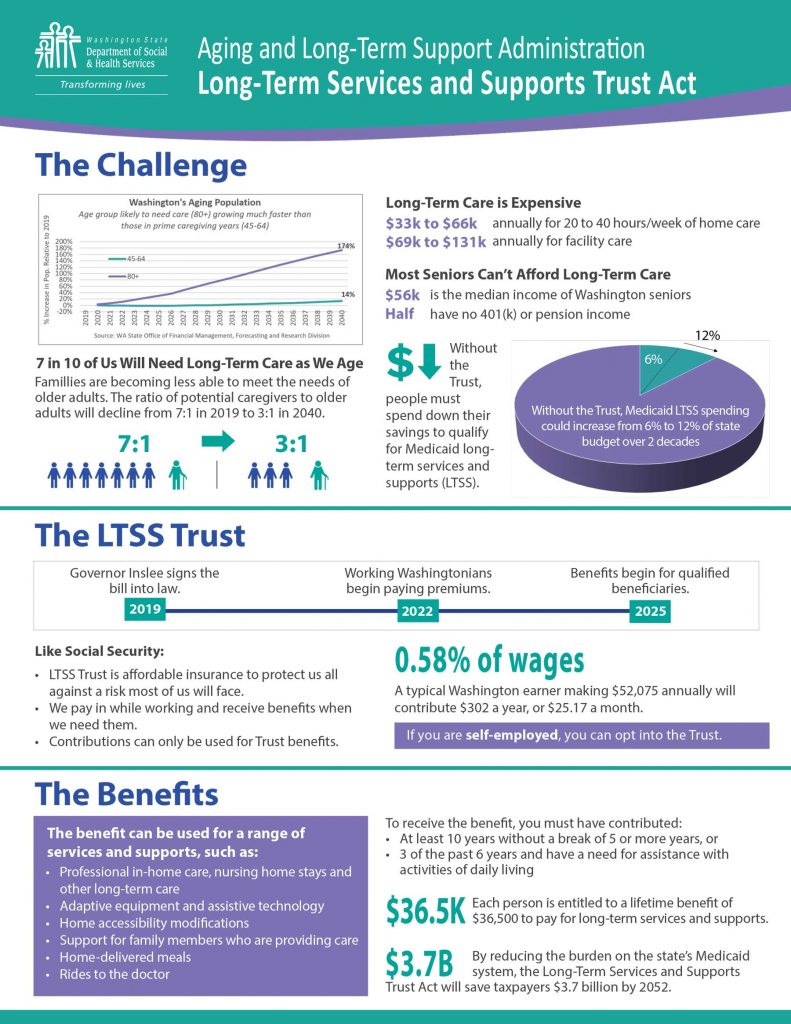

The Act requires any employee who works in Washington state to contribute 058 per 100 0581 of their wages to the Washington Cares Fund the Fund a trust fund set aside to pay long-term care benefits.

. 1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent. Payroll Washington Long Term Care Llc Under current law Washington residents have one opportunity to opt-out of this tax by having a long-term care insurance LTC policy in place by November 1st 2021. This new fund was created by the State Legislature to.

The employee must provide proof of their ESD exemption to their employer before the employer can waive. Workers may need a financial planner and to get some quotes from long-term care insurers but they need to act fast. The State of Washington has now opened their online opt-out procedure for those who have qualifying Long-Term Care Insurance and wish to be exempt from the upcoming payroll tax.

With this youre unable to set up the Washington long-term care insurance in online intuit payroll software yet. Per direction from the Governor ESD will not collect premiums from employers until April 2022 or until further direction is received. Washington States Long-Term Care Trust Act will provide long-term care services to those who pay into the program and need assistance with daily activities.

Washington enacted the Act in 2019 in an effort to plan for the projected long-term care needs of Washington residents. If you have private long-term-care insurance LTCI and want to opt out of a new long-term-care payroll tax starting in January you can apply for an exemption with the state of Washington starting today. The Legislature and Governor Inslee have announced plans to change and improve the WA Cares Fund during the 2022 legislative session which is scheduled to conclude in March 2022.

At least now we know how fast after legislative action taken last night on Substitute House Bill 1323. The new tax is for a mandatory long-term-care program called the WA Cares Fund. The State has strict guidelines that private Long Term Care policy must include in order to qualify for the exception.

W-2 employees can opt out of the Long-Term Care Trust Act by opting in to a private long-term care. But if you want to opt out you may have some. Individuals who have private long-term care insurance may opt-out.

However the said payroll tax is pending release as we wait for additional agency guidance. The WA Cares Fund. In 2019 Democrats in Olympia passed a hefty new payroll tax that will hit paychecks starting in January.

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. Turns out they were a bit premature. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption.

Washington States Long-Term Care Trust Act will provide long-term care services to those who pay into the program and need. AWC partnered with other organizations and employers to successfully push back the opt-out date to November 1 2021 to allow employees more time to consider their long-term. Apr 13 2021 How do I file an exemption to opt out.

In order for the Washington state to allow you an exception to payment of the payroll tax and allow you to opt out of the States Long Term Care plan you will need to show them information about your private policy that is in force prior to your opt out request. The regressive tax is 58 cents per 100 earned with no income limit. The initial premium rate 058.

How opting out of Washingtons new payroll tax can offer money-saving benefits in the long run. I have not had success. Applying for an exemption.

Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account. The date has arrived. You need to already have or purchase a long-term-care plan through a private insurer by.

Opting out of the tax must be done by November 1 2021 and you must buy qualified private long-term care insurance to get out of the public program. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. 1 An employee tax for Washingtons new long-term care benefits starts in January.

Opting back in is not an option provided in current law. Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment. One man I spoke with recently.

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. If you want to opt out of a payroll tax that begins in January assessed to fund a state-run one-size-fits-all long-term-care-insurance fund that you might or might not benefit from read more about the coming tax on our Center for Health Care blog here is what we know. This is a permanent opt-out once out you cannot opt back in.

They reluctantly allowed a single opt-out choice that expires Nov. Opt-out option for Washingtons long-term care tax begins Oct. Washington State is accepting exemption applications between October 1 2021-December 31 2022.

1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit. The premiums are paid by your employees through a 058 payroll tax starting January 1 2022. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and its associated payroll taxes is on its way to the Governor.

Washington State Long-term Care Law On hold until 2023 The somewhat tortured path of the Washington state long-term care requirements continues. For those who got in before the site crashed minutes after it opened I hear it was easy.

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Admet

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Admet

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

Washington State Long Term Care Payroll Tax Steadfast Insurance

What To Know About The Wa Cares Fund Contributions Eligibility Benefits The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 8 Bogleheads Org

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

Payroll Washington Long Term Care Llc

Alert Time Is Running Out To Opt Out Of The New Wa State Ltc Payroll Tax

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Can You Opt Out Of State S New Long Term Care Act And Tax Should You

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Washington State Long Term Care Tax What You Need To Know North Town Insurance

Ltca Long Term Care Trust Act Worth The Cost